Is It Legal for My Roofer to Pay My Deductible?

If you’re wondering, “Is it legal for my roofer to pay my deductible?” Let Camden Roofing & Construction help you out. Roofing repair and replacement may be confusing for homeowners. Concepts such as insurance coverage and costs may turn things complex. The question “Is it illegal for a roofer to waive my deductible?” comes up regularly.

In this sense, we will get deeper into this crucial matter.

Explaining the Concept of an Insurance Deductible

The deductible on your insurance policy is the amount you are responsible for paying out of pocket in the event of a covered loss. Your insurance policy should state the deductible amount.

Roof insurance deductibles work differently than medical deductibles. We must grasp this crucial distinction when learning about insurance policies. If you have health insurance, the insurance company will begin paying a higher share of the cost of your medical care when you reach your annual deductible limit.

However, unlike auto insurance, home insurance deductibles are applied per claim rather than annually. For example, if a hailstorm or the wind damages your roof, you will have to pay your deductible before your insurance kicks in. Thus, you incur the expense only once per event rather than annually.

When planning a budget for house repairs and upkeep, it is crucial to consider this difference.

Deductible Waivers and Their Legality

Many states prohibit roofing companies from paying the homeowner’s insurance deductible. The purpose of this regulation is to safeguard property owners against fraudulent insurance claims. If the insurance company were to offer to waive the deductible, the contractor would likely increase the project cost to make up for the deductible. This practice will result in an inflated claim. To put it simply, it is an insurance fraud.

When Do You Have to Pay a Deductible?

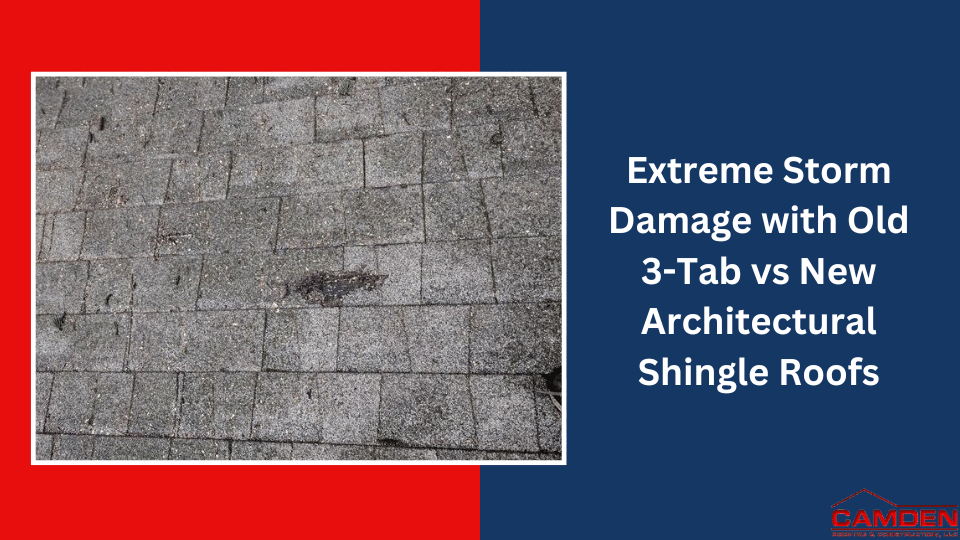

Any time you file a claim for roof damage that your insurance policy covers, the deductible will come into play. Extreme weather events, including storms, hail, and high winds, can lead to significant roof damage.

Another instance where you may use your deductible is whether a tree fell on your house and ruined your roof. A similar process would occur if a fire destroyed your roof. You must file a claim and pay the deductible before the insurance coverage starts.

Indeed, you must pay your insurance deductible before your insurance provider begins paying for any repairs or replacements. Camden Roofing & Construction is here to help you understand the ins and outs of your homeowner’s insurance policy. Our guidance includes telling you what your policy covers and your duties as a homeowner.

How Should Homeowners Proceed?

Do you own a property? If so, familiarize yourself with all aspects of your insurance coverage, including the deductible. If your roof needs fixing or replacing, you should:

- Request multiple estimates from reliable roofing companies to ensure you are getting a fair price.

- Contractors offering to cover your insurance deductible are red flags. A dishonest builder could act this way.

- Always pay your insurance deductible. This way, you will get peace of mind by adhering to the law and your insurance policy conditions.

- Do you have questions regarding filing a claim or your insurance coverage? Contact your insurance provider.

Waiving Your Deductible May Result in Subpar Quality

Did your roofer promise to pay your deductible? Think about this: They must get the money from someplace. So, they may cut back on other aspects of your roof renovation, such as its quality, to absorb the extra cost.

You will get a low-quality roof if the contractor uses cheap or poor-quality materials. Also, they may hire inexperienced workers or finish the job hurriedly. This might cause the roof to fail sooner than expected, requiring more regular maintenance in the future.

The Situation of Insurance Deductibles in North Carolina

Roofing companies who offer to pay customers’ insurance deductible are breaking the law. Thus, roofing companies must follow the law, and property owners must avoid contractors offering to waive deductibles. Otherwise, the contractor may face fines, and the homeowners may fall into a difficult financial and legal position.

For more information, contact Camden Roofing & Construction, LLC in Charlotte and Raleigh, NC at 919-729-5050.